Innocent Spouse Rule — (formally under 26 USCS §6013(e)) — A hardship prevention measure when one spouse (the non-innocent spouse) doesn’t report income, thereby leaving the remaining “innocent spouse” to pay deficiencies. Generally, when married couples file a joint tax return, they

Read More

Most new as of 2024 businesses are required to file within 90 days of registering the company Most new businesses starting January 1st, 2025 are required to file within 30 days of registering the company Other businesses have until the end of

Read More

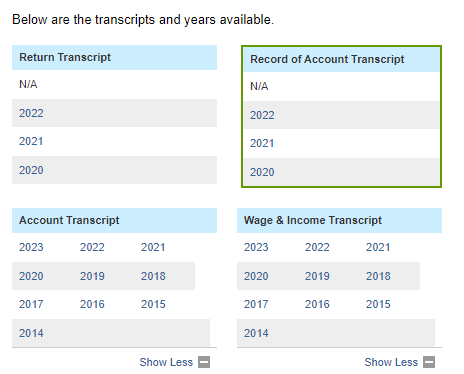

IRS tax transcripts are important documents that provide detailed information about a taxpayer’s tax return and account. IRS tax transcripts allow a taxpayer, as well as a tax attorney representing a taxpayer to know what information the IRS has, as well as

Read More

If your small business is or perhaps more importantly will be netting you over $50,000 this tax year and you’re operating your LLC as a disregarded entity, you may be paying too much in taxes. One potential strategy on reducing your tax

Read More

Failure to file can result in up to $500 a day in penalties Many businesses are exempt from filing, however, you want to make sure you property determine if you are or are not exempt. The stated purpose is to uncover criminal

Read More

Quick important note: Unless you have been living under a rock in the last year, you most likely heard (and still hearing) ads promoting businesses to take the Employee Retention Credit (ERC). Many of the ads are from unscrupulous advisors without credentials,

Read More

Some relief from the California storms Due to the intense storms hitting California in late 2022 and early 2023, the IRS announced in February this year a significant extension of the deadlines for filing and payment of various taxes until October 16,

Read More

As a business owner, filing taxes can be a tedious task. It’s one of those things that no one likes to do, but it’s necessary. When it comes to filing 1099s, the process can be even more stressful. You need to make

Read More