IRS Announces New Program For Tax Payers to Withdraw Employee Retention Tax Credit Refund Claims

Quick important note:

Unless you have been living under a rock in the last year, you most likely heard (and still hearing) ads promoting businesses to take the Employee Retention Credit (ERC). Many of the ads are from unscrupulous advisors without credentials, and thus have a much lower risk because they’re not risking a professional license from their activities.

If you’re considering filing a request with the IRS, make darn sure the company AND the person you’re working with is an attorney, CPA, or Enrolled Agent (EA) AND they have professional liability insurance, so that at least you know the advisor has ethical standards they must follow or risk regulatory sanctions and/or losing their license to practice.

The insurance policy helps protect you in two ways. First, you can expect the advisor wants to KEEP their insurance free from claims, and also, the insurance may pay you if you receive bad advice.

Because the IRS has received so many doubtful ERC claims, the IRS has actually stopped accepting them as the agency attempts to create procedures to better police the applications received. I suspect it also has to do with allowing a pause by business employers to take a second look at the viability of submitting a claim given the amount of marketing directed towards them.

On October 19, 2023, the IRS rolled out a unique mechanism allowing employers to retract previously filed Employee Retention Credit (ERC) claims they suspect might be erroneous.

This initiative lets employers who’ve submitted ERC claims but haven’t yet gotten a refund, retract their submissions. This action will exempt them from any future repayments, interests, and penalties associated with the claim.

The IRS initiated this program in light of businesses potentially being influenced by intense promotional strategies to file ERC claims. These businesses now question the validity of their claims, considering them possibly ineligible.

The ERC serves as a reimbursable tax credit designed for companies that sustained their employee payroll during the COVID19 pandemic, even when facing substantial reductions in revenue or undergoing a partial or total halt in operations due to relevant governmental directives.

However, since its introduction, there’s been a surge in intermediaries overzealously advertising this credit. These intermediaries often incorrectly imply that nearly all companies qualify for the ERC, irrespective of any genuine drop in their earnings or legit suspensions of their business.

These promoters often charge businesses a portion of the expected ERC as their service fee.

Acknowledging these aggressive methods, the IRS has been inundated with ERC applications. Consequently, they decided to halt the processing of new ERC applications temporarily, extending till the year’s close, and implement stringent reviews for existing applications.

Who Is Eligible to Retract a Claim?

Employers can request to retract their ERC claim through the IRS’s new method if they meet the following criteria:

The ERC claim was made using an adjusted employment return (like Forms 941X, 943X, 944X, CT1X).

The adjusted return was solely for the ERC claim without any other modifications.

The intention is to retract the entire ERC claim value.

The IRS hasn’t processed the ERC claim, or if they have, the employer hasn’t accessed or banked the refund amount.

Note: Those who knowingly submitted an erroneous claim or collaborated with others in such actions will still face penalties, with potential legal repercussions.

Steps to Retract an ERC Claim

To engage in the ERC claim retraction process, taxpayers must adhere to specific guidelines provided by the IRS. A summarized version is as follows:

If the ERC claim was filed by professional payroll firms on behalf of taxpayers, it’s advised to liaise with these firms. Depending on the filing method, the payroll firm might need to initiate the retraction.

Self-filing taxpayers who haven’t accessed their refund and aren’t under audit should direct their retraction requests via fax to the IRS.

For employers who’ve received audit notifications, they can forward the retraction request to the designated examiner or answer the audit notification if no examiner has been allocated.

If you need help figuring out if you’re eligible to claim the ERC, use the Employee Retention Credit Eligibility Checklist. If you request to withdraw your claim, you’ll be asking the IRS not to process your entire adjusted employment tax return (Form 941‑X, 943‑X, 944‑X, CT-1X) for the tax period that included your ERC claim.

Claims that are withdrawn will be treated as if they were never filed. The IRS will not impose penalties or interest.

If you made any other changes on the adjusted employment tax return or you only need to reduce your ERC claim (not withdraw it entirely), you can’t use the withdrawal process.

Instead, you need to amend your return. For more information on these situations, see the Correcting an ERC claim – Amending a return section of the frequently asked questions about the ERC.

Who can ask to withdraw an ERC claim

You can use the ERC claim withdrawal process if all of the following apply:

- You made the claim on an adjusted employment tax return (Forms 941‑X, 943‑X, 944‑X, CT-1X).

- You filed your adjusted return only to claim the ERC, and you made no other adjustments.

- You want to withdraw the entire amount of your ERC claim.

- The IRS has not paid your claim, or the IRS has paid your claim, but you haven’t cashed or deposited the refund check.

It’s VERY important to note that if you willfully filed a fraudulent ERC claim, or if you assisted or conspired in such conduct, withdrawing a fraudulent claim will not exempt you from potential criminal investigation and prosecution.

If you’re finding yourself in this situation, it’s very important to obtain representation as quickly as possible, and do NOT communicate with the IRS or any government agencies before doing so.

How to request an ERC claim withdrawal

You will follow different steps depending on your situation.

- You haven’t received a refund and haven’t been notified your claim is under audit

- You haven’t received a refund and you’ve been notified your claim is under audit

- You received a refund check but haven’t cashed or deposited it

If you use a professional payroll company and they filed your ERC claim for you, you should consult with them if you want to withdraw your ERC claim.

Depending on how the company filed your claim – individually or batched with others – you may need to have them submit your withdrawal request.

Section A: You haven’t received a refund and haven’t been notified your claim is under audit

If you filed an adjusted return (Form 941‑X, 943‑X, 944‑X, CT-1X) to claim the ERC and you would like to withdraw your entire claim, use the process below. If you filed adjusted returns for more than one tax period, you must follow the steps below for each tax period for which you are requesting a withdrawal.

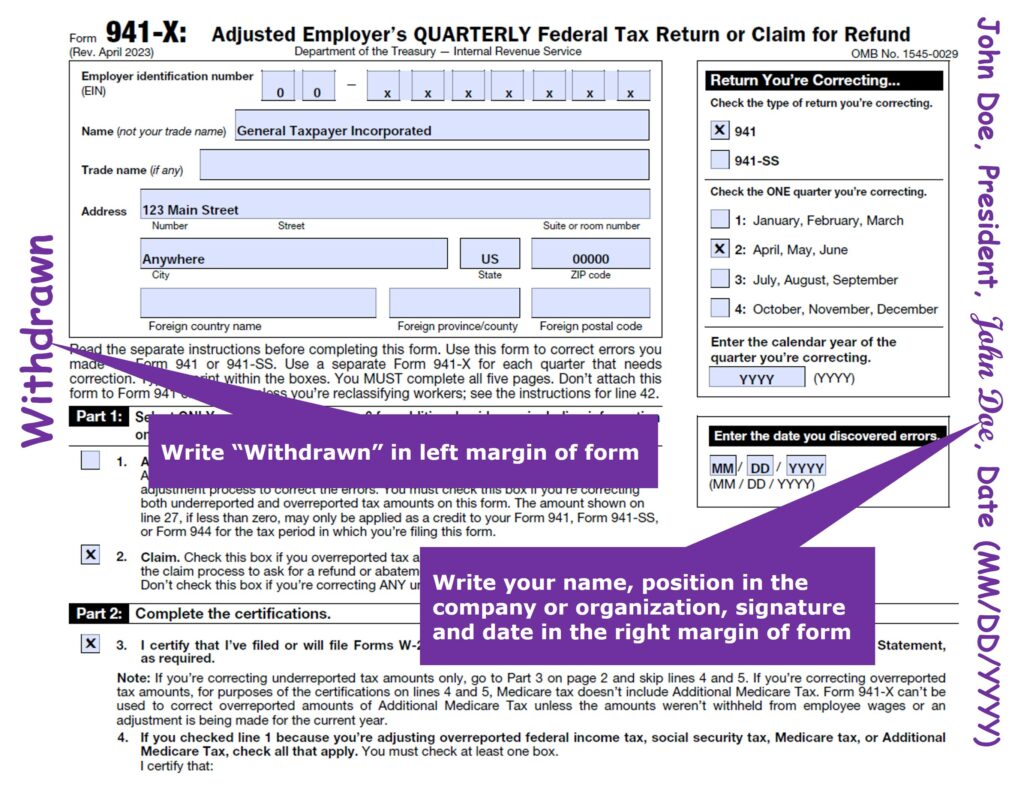

To request a withdrawal, follow these steps:

- Make a copy of the adjusted return with the claim you wish to withdraw.

- In the left margin of the first page, write “Withdrawn.”

- In the right margin of the first page:

- Have an authorized person sign and date

- Write their name and title next to their signature.

- Fax the signed copy of your return using your computer or mobile device to the IRS’s ERC claim withdrawal fax line at 855–738-7609. This is your withdrawal request. Keep your copy with your tax records.

If you can’t fax your withdrawal request, you can mail it to the address in the instructions for the adjusted return that applies to your business or organization. Before doing so you should make a copy of the signed and dated first page to keep for your records.

It will take longer for the IRS to receive your request if you mail it. Track your package to confirm delivery.

Section B: You haven’t received a refund and you’ve been notified your claim is under audit

At this point you may want to engage a tax attorney, as well as the advisor submitting the claim(if any) for you, if for nothing else, to review your business and claim before you communicate with the IRS.

However, if you would like to proceed on your own, the IRS instructs the following:

If you’ve been notified that the IRS is auditing the adjusted return that includes your ERC claim, prepare your withdrawal request using the steps in Section A, but don’t submit to the withdrawal fax line or mail it using the address below. Instead:

- If you’ve been assigned an examiner, communicate with your examiner about how to submit your withdrawal request directly to them.

- If you haven’t been assigned an examiner, respond to your audit notice with your withdrawal request, using the instructions in the notice for responding.

Again, I have to stress that you may be well served by discussing the matter with a tax attorney or tax professional before taking any action.

Section C: You received a refund check but haven’t cashed or deposited it

- Prepare the claim withdrawal request using the steps in Section A, but don’t fax the request.

- Write “Void” in the endorsement section on the back of the refund check.

- Include a note that says, “ERC Withdrawal” and briefly explain the reason for returning the refund check.

- Make copies for your tax records of the front and back of the voided check, the explanation notes and the signed and dated withdrawal request page.

- Don’t staple, bend or paper clip the voided check; include it with your claim withdrawal request and mail it to the IRS at:

Cincinnati Refund Inquiry Unit

PO Box 145500

Mail Stop 536G

Cincinnati, OH 45250

Track your package to confirm delivery.

What happens next

The IRS will send you a letter telling you whether your withdrawal request was accepted or rejected. Your approved request is not effective until you have your acceptance letter from the IRS.

If your withdrawal is accepted, you may need to amend your income tax return. If you need help, seek out a trusted tax professional. You’re welcome to reach out to Robert W Law for a review.