Real estate investing can be lucrative with proper planning and execution, albeit if you’re not careful or have an experienced tax advisor, you could learn after the fact you owe much more in tax than you expected or planed for. Here, we’ll

Read More

Cost Segregation Studies break out your rental components into different depreciation schedules Cost Segregation Studies often do not require an engineer to visit your property, making the cost much more affordable than many real estate investors realize Cost Segregation of rental properties

Read More

Business Tax advisory and tax preparation Tax preparers are NOT tax advisors, so know the difference Almost all tax preparers do not provide meaningful tax advisory and planning, they simply prepare tax returns as quickly as they can with minimal surface-level advice

Read More

2017 Tax Changes removed the ability to reduce income based on unreimbursed expenses. Taking an expense approach with a home office may leave you with a future tax bill for depreciation recapture. An Accountable plan allows business owners to reduce business income,

Read More

An open and transparent list of fees and offerings is important to understand your investment in reaching a resolution, and thus, you can anticipate the following fee schedule starting with tax advisory services, followed by tax resolution services. Initial Meeting for Personal

Read More

As of late 2024, employees generally can’t expense (write off) work related expenses and cost nearly to the level of business owners. Some exceptions do apply, including if the use of a home office is for the convenience of the employer. Sadly,

Read More

Updated September 2024 The rise of short-term rental platforms, including Airbnb and Vrbo has changed and revolutionized the real estate market, giving rise and opportunity to a potentially lucrative sector (along with many pitfalls): short-term rentals. For many investors, the appeal of

Read More

Common Business Owner Mistakes — I commented recently on a few social posts seeking guidance on tax treatment and entity questions in general. I thought it may be helpful to make a post of some of the biggest mistakes I see business

Read More

Tax Resolution is finding mutually agreeable resolutions to past tax debts Offers in Compromise is settling a tax debt for less than you owe Installment Agreements are paying either some or all of your tax debt over time. Back-door Offer in Compromise

Read More

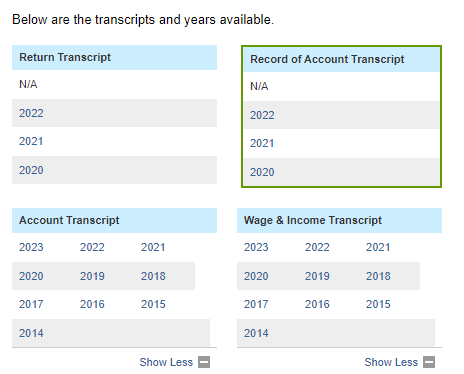

IRS tax transcripts are important documents that provide detailed information about a taxpayer’s tax return and account. IRS tax transcripts allow a taxpayer, as well as a tax attorney representing a taxpayer to know what information the IRS has, as well as

Read More