How and Why to Obtain Your IRS Taxpayer Transcripts

IRS tax transcripts are important documents that provide detailed information about a taxpayer’s tax return and account.

IRS tax transcripts allow a taxpayer, as well as a tax attorney representing a taxpayer to know what information the IRS has, as well as what tax filings are complete or missing

Obtaining your transcripts is the first step in catching up if you have back taxes to “catch up on” and file to become compliant.

If you’re reading this page, it’s likely you found it from an online search or a request by my office to obtain your IRS transcripts.

If we asked for your transcripts, and you would rather have us obtain them, we will have you sign an authorization form and we can obtain your taxpayer information. However, in the interest of saving clients’ money and time, it’s often better for the taxpayer to obtain them.

Having my office obtain the IRS tax transcripts takes longer because we have to go through the authorization process to do so, and it doesn’t always work (~80% success rate), so it often saves the taxpayer money and time performing the task.

Navigating the complex world of tax documentation can be daunting for many taxpayers. One of the essential documents you might need as a taxpayer is an IRS tax transcript.

There are several key reasons why a taxpayer may want to obtain their IRS tax transcripts:

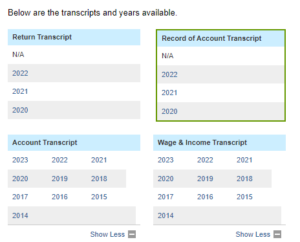

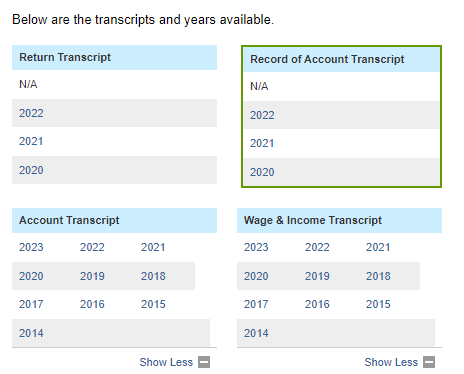

Verifying Tax Return Accuracy: Tax transcripts can be used to double-check the information on a tax return, ensuring it is complete and accurate. This can help avoid potential issues or delays with the IRS.

Applying for Loans or Benefits: Transcripts may be required when applying for a mortgage, student loans, or government benefits, as they provide a consolidated summary of a taxpayer’s tax information.

Tracking Tax Account Changes: Account transcripts show any changes made to a tax return after it was filed, such as additional payments or adjustments. This can be helpful for taxpayers to monitor their account.

Obtaining Income Documentation: Wage and income transcripts list the income forms (W‑2s, 1099s, etc.) reported to the IRS, which can be useful if a taxpayer is missing these documents.

To obtain IRS tax transcripts, taxpayers can request them online through their IRS account, by phone, or by mail using Form 4506‑T. The fastest way generally is right online at the IRS website https://www.irs.gov/individuals/get-transcript

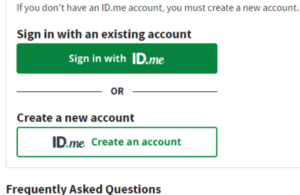

Once at https://www.irs.gov/individuals/get-transcript, you will click the blue button “Get transcript online.”

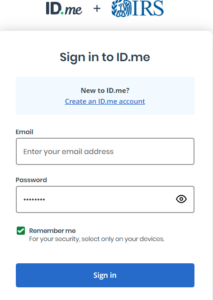

From there, you will be required to verify your identity with “ID.me” Generally the process is relatively easy, as you’ll be asked questions you are the only one who knows (Although, it wouldn’t be a surprise if one spouse can answer the questions for the other if you’ve been married as long as I have).

The next step once you’re setup with ID.me is to receive a code by phone or text.

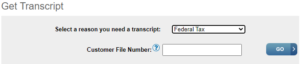

After having your identification confirmed, you will reach a page that asks for the purpose of the transcripts. “Select a reason you need a transcript:” any answer is fine and doesn’t impact your ability to obtain transcripts (in the context you don’t require any reason beyond you want to obtain your information). That said, your selection does impact the options available and for that reason, I suggest “Federal Tax” as that will provide the most options available. You don’t need to enter anything for Customer File Number if you’re obtaining transcripts for yourself.