An open and transparent list of fees and offerings is important to understand your investment in reaching a resolution, and thus, you can anticipate the following fee schedule starting with tax advisory services, followed by tax resolution services. Initial Meeting for Personal

Read More

For both new and experienced rental property owners, navigating the complexities of real estate lease agreements can be challenging, and even seasoned professionals can make mistakes. Some of these mistakes can be painfully expensive as was recently demonstrated in a Wisconsin real

Read More

As of late 2024, employees generally can’t expense (write off) work related expenses and cost nearly to the level of business owners. Some exceptions do apply, including if the use of a home office is for the convenience of the employer. Sadly,

Read More

Most new as of 2024 businesses are required to file within 90 days of registering the company Most new businesses starting January 1st, 2025 are required to file within 30 days of registering the company Other businesses have until the end of

Read More

Regarding the proposal to tax unrealized capital gains— A recent thread discussing this within a FB group I follow had a comment that the tax on property is akin to the proposal of taxing unrealized capital gains and I pointed out the

Read More

Updated September 2024 The rise of short-term rental platforms, including Airbnb and Vrbo has changed and revolutionized the real estate market, giving rise and opportunity to a potentially lucrative sector (along with many pitfalls): short-term rentals. For many investors, the appeal of

Read More

Common Business Owner Mistakes — I commented recently on a few social posts seeking guidance on tax treatment and entity questions in general. I thought it may be helpful to make a post of some of the biggest mistakes I see business

Read More

California Governor Gavin Newsom on recently signed a bill into law requiring employers to provide notice to employees that they can consult and seek the advice of an attorney for guidance about their rights under the state’s workers compensation law. Under A.B.

Read More

Tax Resolution is finding mutually agreeable resolutions to past tax debts Offers in Compromise is settling a tax debt for less than you owe Installment Agreements are paying either some or all of your tax debt over time. Back-door Offer in Compromise

Read More

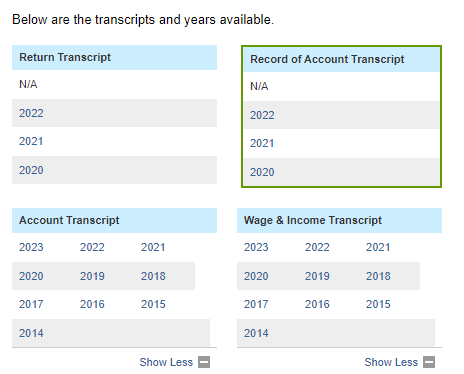

IRS tax transcripts are important documents that provide detailed information about a taxpayer’s tax return and account. IRS tax transcripts allow a taxpayer, as well as a tax attorney representing a taxpayer to know what information the IRS has, as well as

Read More