Short-Term Rental Investments and Taxation

Updated September 2024

The rise of short-term rental platforms, including Airbnb and Vrbo has changed and revolutionized the real estate market, giving rise and opportunity to a potentially lucrative sector (along with many pitfalls): short-term rentals. For many investors, the appeal of earning substantial income through vacation rentals or temporary housing solutions is strong.

However, like any investment, diving into short-term rentals requires a solid understanding of the industry’s intricacies, from legal requirements and financial benefits to potential risks. This comprehensive guide will explore everything investors need to know to successfully navigate the short-term rental market.

1. Understanding Short-Term Rentals

Short-term rentals (STRs), often referred to as vacation rentals, are properties rented out for a short duration, typically ranging from a single night to a few weeks, and generally less than 30 days (and there is a 7 day average stay rule as well that investors need to be aware of). Unlike traditional long-term rentals, Short-term rentals cater to tourists, business travelers, and individuals seeking temporary housing. The flexibility and convenience of short-term rentals make them a popular choice for travelers and a potentially profitable venture for property owners.

Types of Short-Term Rentals:

- Entire Homes/Apartments: Renting out an entire property, providing complete privacy to guests.

- Private Rooms: Renting out a room within a property where other parts of the property, such as the kitchen or living room, may be shared with the host or other guests.

- Shared Spaces: Guests share common areas with the host or other guests, typically at a lower cost.

2. Legal and Regulatory Requirements

Investing in short-term rentals requires careful attention to local laws and regulations, which can vary significantly depending on the location.

Zoning Laws and Regulations:

- Zoning Restrictions: Many cities have specific zoning laws that dictate where short-term rentals can operate. Some areas may prohibit STRs in residential zones or require special permits.

- Licensing and Permits: Some jurisdictions require property owners to obtain licenses or permits to operate short-term rentals. These can range from a basic business license to specific STR permits that may involve inspections and fees.

- Occupancy Limits: Regulations may limit the number of guests that can stay in a short-term rental at one time. These limits are often based on the size of the property or the number of bedrooms.

Taxation:

- Local Taxes: Many areas and jurisdictions impose transient occupancy taxes (TOT) or similar levies on short-term rental income. These taxes are typically calculated as a percentage of the rental rate and must be collected from guests and remitted to the local government. It’s also important to note that multiple jurisdictions may have an occupancy tax.

Such as one for the local city, one for the county, one for a special tax district (generally near major sport’s arenas), and another for a state.

- Income Tax: Income generated from short-term rentals is subject to federal and state income tax. Investors must keep detailed records of their earnings and expenses to accurately report this income. As described in the following, the nature of the income for short-term rentals also depends on many factors that need special consideration BEFORE making an investment.

Homeowners Association (HOA) Rules:

- HOA Restrictions: Properties within an HOA may be subject to additional rules regarding short-term rentals. Some HOAs may prohibit STRs entirely, while others may have specific guidelines that must be followed.

Insurance Requirements:

- Insurance Coverage: Standard homeowner’s insurance policies generally do not cover short-term rental activities (depends on the nature of the rental ie a room in your primary home vs another property). Investors should consider specialized Short-Term Rental business insurance policies that cover potential liabilities, such as property damage or guest injuries.

3. Financial Benefits of Short-Term Rentals

The financial benefits of short-term rentals can be substantial, making them an attractive option for real estate investors.

Higher Income Potential:

- Premium Pricing: A main attraction is the appeal that Short-term rentals often command higher nightly rates compared to long-term rentals, especially in high-demand areas or during peak seasons. This can result in significantly higher annual income compared to traditional leasing.

- Seasonal Pricing: Investors can adjust pricing based on demand, charging higher rates during holidays, special events, or peak tourist seasons.

Flexibility and Control:

- Personal Use: Owners have the flexibility to use the property themselves when it’s not rented out, offering a dual benefit of income generation and personal vacation use.

- Tenant Control: Unlike long-term rentals, where tenants may stay for a year or more, short-term rentals allow owners to choose when and who to rent to, minimizing the risk of dealing with problematic tenants.

Tax Deductions:

- Deductible Expenses: Many expenses associated with maintaining and managing a short-term rental can be deducted from rental income, including property management fees, maintenance costs, and even certain travel expenses related to property upkeep.

- Depreciation: Investors can also benefit from depreciation deductions, which can offset taxable income from the property over time. The depreciation schedule may change if the rental is a classified as a business (ie commercial) vis-a-vis habitational.

Property Value Appreciation:

- Long-Term Investment: In addition to the rental income, property values in desirable locations tend to appreciate over time, providing investors with long-term capital gains when the property is eventually sold.

4. Challenges and Risks of Short-Term Rentals

While the potential rewards of short-term rentals are enticing, investors must also be aware of the associated challenges and risks.

Regulatory Risk:

- Changing Laws: Regulations surrounding short-term rentals are constantly evolving. Cities, municipalities, and HOAs may impose new restrictions, increase taxes, or even ban short-term rentals altogether, which can impact an investor’s ability to operate.

- Compliance Costs: Keeping up with regulatory requirements can be time-consuming and costly. Failing to comply with local laws can result in fines, legal action, or the forced closure of the rental.

Market Competition:

- Saturation: In popular tourist destinations, the market for short-term rentals can become saturated, leading to increased competition and potentially lower occupancy rates. Investors must carefully research market demand and consider the potential for over-saturation in their chosen location. As of 2024, we’ve seen this play out in many areas of the country, especially in the Florida market.

Operational Challenges:

- Management Intensive: Short-term rentals require ongoing management, including cleaning, maintenance, guest communication, and marketing. This can be time-consuming, especially for investors managing multiple properties. One of the questions involved includes “Substantial Services.”

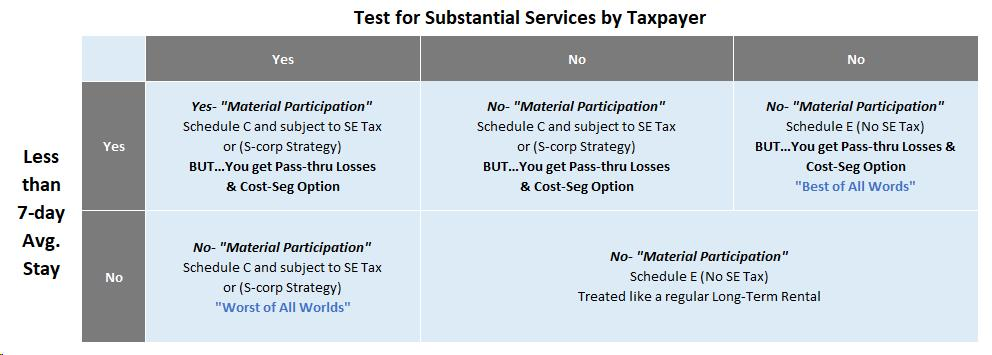

Substantial Services provided can change the nature of the short-term rental from a typical residential rental into a business activity, which is the goal of many investors, albeit doing so must be planned and executed correctly to avoid unexpected surprises come tax time.

- Turnover Costs: The frequent turnover of guests can lead to higher maintenance costs and wear and tear on the property. Regular deep cleaning, restocking of supplies, and repairs are necessary to maintain a high standard and good reviews. Generally, new short-term rental owners often find the expenses are far greater than expected, and this becomes even more the case for distant short-term rentals where the owner must rely upon others to perform all the work.

Taxation Rules for Short-Term Rentals

Taxes on short-term rentals can be complex due to the varying rules that apply to rental income, deductions, and occupancy taxes. Consider this as a starting point, and if I emphasize anything, let me highlight that this is not a “do it yourself” from a taxation point of view for the new real estate investor. Below are a few top-level areas investors must consider when it comes to taxation:

Federal Income Tax Treatment:

- Rental Income: Income generated from short-term rentals is typically considered taxable by the IRS and must be reported on your tax return. Even if you receive payment through a third-party platform like Airbnb, the IRS still requires you to report the rental income.

- Exception for Short Rentals (14-Day Rule): Often called the Augusta Rule, albeit likely more often used in California in the movie industry — If you rent out your property for fewer than 15 days in a year, and it’s used as a personal residence for the remainder of the year, the rental income is generally exempt from federal income tax if all the requirements are met. However, you also cannot deduct expenses related to the rental period in this case. Also, there are many rules regarding the tax exclusion of the income and documentation of following the requirements are VERY important. Many business owners will rent their home for an annual meeting of a day or two in order to transfer funds from the business (creating a deductible expense), to their personal account for rent paid (which does not have to be counted as income) using this rule.

- Rental vs. Self-Employment Income: Depending on how involved you are in managing the rental (such as cleaning, providing amenities, or regularly interacting with guests), your short-term rental income may be classified as “self-employment” income. This is especially true if you provide substantial services to guests. In this case, you would need to pay self-employment taxes, which include Social Security and Medicare taxes. The IRS uses the distinction between passive rental income and active participation to determine whether you need to report this as self-employment income.

- State Income Tax: In addition to federal income tax, short-term rental income is also subject to state income tax, depending on the state in which your rental is located. You’ll need to check with your state tax authority to understand specific requirements.

- Sales Tax: Some states treat short-term rental services as taxable under their sales tax laws. Like occupancy taxes, sales taxes are generally a percentage of the rental rate charged to guests. It’s essential to determine if your state requires you to collect sales tax in addition to occupancy taxes.

Deductions and Depreciation:

One of the most attractive aspects of investing in short-term rentals is the range of deductions available to offset rental income. Here are some of the key tax deductions investors can benefit from:

- Mortgage Interest and Property Taxes: Similar to long-term rentals, mortgage interest and property taxes on a short-term rental can be deducted. If you live in the property part-time, you likely need to prorate these deductions based on the percentage of time the property is rented out versus personal use.

- Operating Expenses: Many operating expenses directly related to running a short-term rental can be deducted from your rental income. There are many involved and beyond the scope of this overview.

- Repairs and Maintenance: Expenses related to necessary repairs and regular maintenance to keep the property in rentable condition are deductible. This can include painting, plumbing repairs, landscaping, and appliance servicing.

- Depreciation: The IRS allows property owners to depreciate the value of the rental property over 27.5 years, which can significantly reduce taxable income. Depreciation applies to the structure itself (not the land), and it spreads out the cost of the property over time. However, if you use the property for personal purposes, the depreciation must be prorated according to the percentage of time the property is rented versus personal use.

Short-Term Rental Losses:

For many short-term rental investors, especially those starting, the property may incur losses due to significant upfront costs like renovation or furnishing. The IRS has rules about when and how you can deduct these losses:

- Passive Activity Loss Rules: Generally, short-term rental activities are considered passive investments under IRS rules. This means that rental losses can only be used to offset other passive income. If you don’t have other passive income to offset, the losses can be carried forward to future tax years.

- Material Participation Exception: If you materially participate in the management of your short-term rental (spending at least 100 hours annually and more than any other person), the rental may be considered non-passive, allowing you to deduct rental losses against other types of income (such as wages).

- Limitations on Deductions: Deductions for short-term rental losses are subject to limitations. Unless you qualify for better treatment, for example, as a Real Estate Professional, the IRS imposes a $25,000 limit on rental loss deductions for individuals with an adjusted gross income (AGI) of $100,000 or less. For every $2 of income over $100,000, the $25,000 limit is reduced by $1, and it phases out entirely at an AGI of $150,000.

Self-Employment Tax Considerations:

As mentioned earlier, if your involvement in managing the short-term rental is significant, called the Substantial Services test, the IRS may classify your activity as a business rather than a passive investment. In this case, your rental income will be subject to self-employment tax, in addition to federal and state income tax.

How does one demonstrate Substantial Services? Generally, if the services provided are akin to a hotel stay, then the taxpayer may be able to demonstrate they are providing substantial services. These include as example:

- Cleaning of the rental each day while the property is occupied by the same guests.

- Changing bed sheets and other linens each day while the property is occupied by the same guests.

- Concierge services.

- Conducting guest tours and outings.

- Providing meals and entertainment (including providing breakfast each morning and/or entertainment at night).

- Providing transportation.

- Providing other common “hotel-like” services.

A key factor is that changing the nature of the short-term rental into a business may have a positive or highly negative impact on your tax obligations without proper planning.

What about Material Participation?

I wrote an article regarding Real Estate Professional Status that you may also find helpful -> https://robertwlaw.com/property-law/real-estate-professional-status/96/

The IRS has a test for determining Material Participation. A taxpayer generally must meet at least ONE (not all, or even more than one) of the material participation tests in order to demonstrate material participation and are as follows:

- The taxpayer investor participates in the activity for more than 500 hours during the year.

- taxpayer investor’s participation in the activity for the taxable year constitutes substantially all of the participation in such activity of all individuals (including individuals who are not owners of interests in the activity) for any given year. If you hire others, that counts against this test.

- The individual participates in the activity for more than 100 hours during the taxable year, and such an taxpayer investor’s participation in the activity for the taxable year is MORE than the participation in the activity of any other individual (including individuals who are not owners of interests in the activity) for such year.

- The activity is a significant participation activity for the taxable year, and the individual’s aggregate participation in all significant participation activities during such year exceeds 500 hours.

- The taxpayer investor materially participated in the activity for any five taxable years (whether or not consecutive) during the ten taxable years that immediately precede the taxable year

- The activity is a personal service activity, and the individual materially participated in the activity for any three taxable years (whether or not consecutive) preceding the taxable year.

- Based on all of the facts and circumstances, the individual participates in the activity on a regular, continuous, and substantial basis during such a year.

In order to qualify, it’s very important to understand what participation means and doesn’t mean. One question I receive often is “does searching for properties in the Multiple Listing Service (or other places count?) Searching for new properties to buy generally does NOT count, and documentation is once again, very important.

- Social Security and Medicare Taxes: Self-employed individuals must pay both the employer and employee portions of Social Security and Medicare taxes (totaling 15.3%). This can significantly impact your tax liability if your rental is classified as self-employment income. Again, it’s a potential “gotcha” for those that don’t properly plan and execute the plan.

As you likely can tell, there are many factors to navigate, and often timing is an important criteria. For example, buying a short-term rental near the end of the year can possibly make it easier for a given taxpayer to meet at least one of the tests, while also enabling the same taxpayer to pivot away from all the work in future years.

Understanding depreciation treatment is important because the depreciation schedule depends on how the property is characterized for any given year. For example, the taxpayer may want to take greater depreciation against other active income, and understanding HOW to enable it is one of the keys of success. Even if the depreciation changes in subsequent years, proper planning may be highly advantageous to a taxpayer who doesn’t otherwise qualify to take passive losses against active income, and/or wants to deduct more than $25,000 in a given year.